Accounting teams use the general ledger to track how well a company performs financially. They compare the most recent transactions to the previous ones, investigate discrepancies, and bring in all the numbers for the balance sheet. But manual reconciliation is time-consuming, so RPA can speed this part up by doing it automatically.

With robotic process automation (RPA), account reconciliation can be streamlined and automated, reducing human error and time-consuming manual checks. In addition, when you add in AI and machine learning, bots can “learn” the process, completing the tasks quickly and accurately.

Finance teams can be more productive with a mix of attended and unattended RPA. Most importantly for financial organizations, RPA solutions allow for varying levels of data protection to comply with today’s rigorous security standards.

What are the benefits of RPA for statement reconciliation?

By employing RPA technology, your firm can free its employees from mundane tasks, freeing them to work on higher-value activities. An automated solution can improve the integrity of financial statements while speeding up reconciliations and limiting the risks inherent in manual processing. A fully integrated system can provide end-to-end visibility and control, enabling you to reallocate critical thinking and problem-solving efforts into areas with the highest business impact.

Multiple Sources of Data

RPA can pull data from Excel spreadsheets, accounts payable and accounts receivable systems, purchase orders, bank statements, and other data formats in real-time, completing reconciliations flagging discrepancies for investigation. In addition, general ledger and balance sheets are automatically updated in real-time.

Account Reconciliations

RPA can perform account reconciliations, including accounts receivable and accounts payable statements, bank statements, access the general ledger and sub-ledgers data, and propose adjusting entries. As a result, records are matched with high accuracy, reducing costly errors.

Trial Balances

RPA software bots can automate trial balance calculations, and post any adjustments to the general ledger by extracting transaction data for the current period, performing a trial balance, noting it in the general ledger, and preparing an adjusting entry if there is a discrepancy.

Improve Accuracy

RPA can handle high-volume transactions and repetitive tasks like data entry that typically take a significant amount of time. In addition, intelligent automation leads to less human error, more efficiency and accuracy, a faster close process, and flags discrepancies for human intervention while processing manual tasks.

Cost Reductions

Automating business processes such as high volume data entry, matching transactions and validation, invoice processing, and reconciliation using RPA software can reduce costs. For example, RPA can simultaneously validate financial information on multiple accounts, streamlining the workflow and decreasing the time to financial close each month.

Improved Compliance

RPA bots can automate manual controls and establish audit trails to identify the exact processes and when they run. In addition, it can be programmed to multi-jurisdictional accounting standards and update information in real-time. This makes preparing for audits easy as opposed to manually gathering documentation.

Discover How Automation Can Reduce Errors and Improve Cash Flow.

See how RPA with Automation Anywhere simplifies reconciliation.

Request demoWho benefits from RPA for statement reconciliation?

An RPA solution not only benefits the finance department by streamlining business processes and workflows, but it can also benefit several other areas of your company. So let’s take a look at how RPA software can help your organization.

Accounts Payable

Instead of spending a significant amount of time matching transactions and payments to invoices, the accounts payable team can focus on resolving discrepancies the RPA system flags for investigation. Higher-value work leads to more job satisfaction.

Accounts Receivable

RPA can automate customer on-boarding, invoice generation and distribution, customer credit monitoring, dispute monitoring, follow-ups, chargebacks, automatically match payments with invoices, update customer accounts, and generate statements.

Customer Relations

Accurate invoices, prompt payment, and quickly resolving discrepancies can result in more favorable credit terms, better vendor and supplier relationships, a good corporate reputation, and a positive cash flow. In addition, Santander saved 30,000 hours of labor by implementing RPA.

Audit and Compliance

Intelligent automation can simultaneously comply with multi-jurisdictional audit and compliance requirements, reconcile intercompany accounts and general ledger and provide an audit trail of actions. This strengthens governance and validates general ledger and account data.

Customer Story

When you choose a partner for your intelligent automation journey, don’t do it on a purely cost basis, but ensure you select a partner that will support you at the times you need it most. Automation Anywhere was with us on every moment of our journey, helping us achieve our success.

100%

reduction in process cycle time

33%

reduction in manual labor

24/7

unlimited billing capacity

How RPA for statement reconciliation can help your finance department?

Suppose your finance department no longer spent hours doing manual data entry and reconciling purchase orders. But, in that case, payments and shipping manifests to cross-check and manually update excel spreadsheets and general ledger entries, what would they focus on? Intelligent Automation can handle mundane, manual tasks that are time-consuming and prone to human error, allowing your organization to run more efficiently and effectively.

Record to Report

- Reconcile accounts by accessing general ledger data, validating information, flag discrepancies

- Simultaneously work on intercompany accounts and general ledgers for an accurate financial picture

- Automate trial balance to extract current period transaction data and validate period-ending balance

- Build line-item budgets for cost-center level reporting

- Perform preliminary reconciliations flag discrepancies for adjustment or investigation

- Auto-generate reports or generate reports on demand

Governance

- Ensure regulatory compliance, automate manual controls, and tighten governance of financial processes

- Amalgamate data from multiple sources to support tax accounting, filings, and sales and use taxes calculation

- Automate multi-jurisdictional audit and account standards simultaneously

- Create an audit trail of journal entries, cost center updates, regulatory and financial report preparation

- Populate financial statements, prepare exception reports, annotate with detailed audit trails

- Automate document verification and authentication, flag discrepancies and potential fraud in real-time

Statement Reconciliation

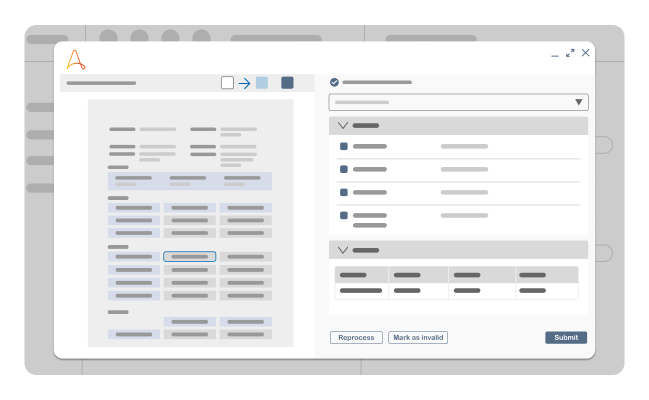

- Automate invoice/payment processing and record management with the Digital Oracle Accounts Payable Clerk bot

- Intelligent automation reconciles statements from legacy systems, email, PDFs, printed invoices or e-files

- Auto-flag missing or duplicate credit notes, invoices and discrepancies for investigation

- Automate invoicing and payments, customer accounts and general ledger updates in real-time

- Matching transactions catch discrepancies sooner for investigation, improves cash flow and accuracy

- Access real-time updates to their accounts directly, building trust, reducing inquiries

Business Continuity

- Quick and efficient matching of records with fewer exceptions, 24/7/365

- Operate during staff shortages, natural disasters or business disruptions

- Automate manual processes and data validation checks to improve the efficiency of financial operations

- RPA works across all platforms, including legacy systems and multi-company general ledger accounts

- Digitizing statements and reconciliations creates less storage demands, provides access across platforms

- RPA delivers real-time financial data on demand, supporting external reporting and business decision-making

What to look for in RPA platform for statement reconciliation?

If you’re thinking of incorporating RPA into your finance team workflows, there are a few things to keep in mind when evaluating a provider. Asking the right questions is an excellent place to start.

How easy is the RPA solution to learn and implement? Is it scalable to your organization? Is it easy to understand and customizable to your needs?

Your solution should be compatible with your platform, integrating with legacy systems. Single sign-on (SSO) opportunities are a significant plus, reducing the time spent logging into various accounts.

You should also know how the platform deals with governance and compliance protocols. Security and compliance should be built into the solution with out-of-the-box functionality, the ability to share data based on user roles, and an audit trail to ensure everything is working as it should.

How to get started?

You can reach out for a free guided demo and ask for help with a proof of concept geared toward your unique business. Designed to be intuitive and straightforward, anyone can start making software bots that add value to your organization.

We offer a comprehensive training platform at Automation Anywhere University, to assist your staff to grow their capabilities to create automated systems to meet your organizational needs.

Request demoMore RPA for Statement Reconciliation Resources.

Get to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.