Automation Use Cases in Insurance.

Underwriting

- Data Entry & Aggregation

- External Data Sourcing

- Medical Record Review (Life)

- Fraud Detection

- Risk Assessment

- Product Development

- Pricing

Claims Management

- Claim Intake

- Settlement Notification

- Payment Processing

- Adjuster Assignment & Triage (P&C)

- Subrogation (P&C)

- Physician Statement Collection (Life)

- Fraud Detection

- Claim Review & Approval

- Investigation & Adjudication (P&C)

Policyholder Service

- Policyholder Info Updates

- Customer Service Support

- Policyholder Billing

- NIGO Remediation (Life)

- Surrenders & Lapses (Life)

- Renewals & Cancellations (P&C)

- Payment Status & Processing

- Policy Issuance

Agency Management

- New Agent Setup

- Agent Licensing

- Agent Compensation

- Agency Performance Reporting

- Policyholder Service

Data Management

- Data Mining

- Data Validation

- Legacy System Data Migration

- Compliance & Internal Audit Data Testing

Finance

- Accounts Payable/ Invoice Processing

- Accounts Receivable

- GL Reconciliations

- Manual Journal Entries

- Treasury Operations

- Management & External Reporting

- Tax Master Data Management

Apply intelligent automation for risk, costs, and customer experience.

Harness intelligent automation, AI, and RPA across insurance operations, including:

Effortlessly extracting data from diverse documents.

Efficiently managing and organizing extensive data sets.

Rapidly addressing customer inquiries.

Recognizing cross-selling prospects.

Discover the benefits of intelligent automation for insurance operations.

Reduce costs

Streamline insurance operations and improve productivity by automating repetitive processes.

Accelerate claims handling

Automate document processing and claims workflow to improve timeliness and accuracy.

Enhance underwriting

Improve access to internal and external data sources to enrich risk analysis and product development.

Improve customer service

Provide real-time access to, customer data and accelerate completion of customer requests.

Increase policyholder retention

Identify retention risks and proactively offer products/services to meet customer needs.

Empower human resources

Free-up employees to perform value-adding analytical activities.

Intelligent automation fuels expansive digital transformation at Dia-ichi Life insurance company.

Dai-ichi Life chooses Automation Anywhere for exceptional ease of use that allows users to create bots without prior programming knowledge.

CUSTOMER STORY

We are saving 132,000 hours annually by implementing RPA to perform 460 tasks across the company.

132K

processes automated

460

months average ROI per process

39

months break-even point

Intelligent automation is ready for every department and function, even legacy systems.

Eliminate manual data extraction for claims management

Document Automation extracts data from various forms, RPA aids coverage verification, triage, and claims assignment, while CoE Manager offers claims analytics on volume, frequency, severity, type, status, and closure time.

Collect, organize, and aggregate all underwriting data, hands-free

Document Automation extracts data for risk analysis and pricing in commercial insurance. RPA formats data for underwriting and actuarial analysis, while attended automation aids collaboration with CSRs and agents.

Improve customer experience with a little help from bots

Attended automation enables customer service representatives to quickly aggregate customer and product information, address service requests, cross-sell insurance products, and interact with underwriters in real-time.

Automate complex Insurance processes end to end.

See how intelligent automation helps accelerate everything from claims handling to product development.

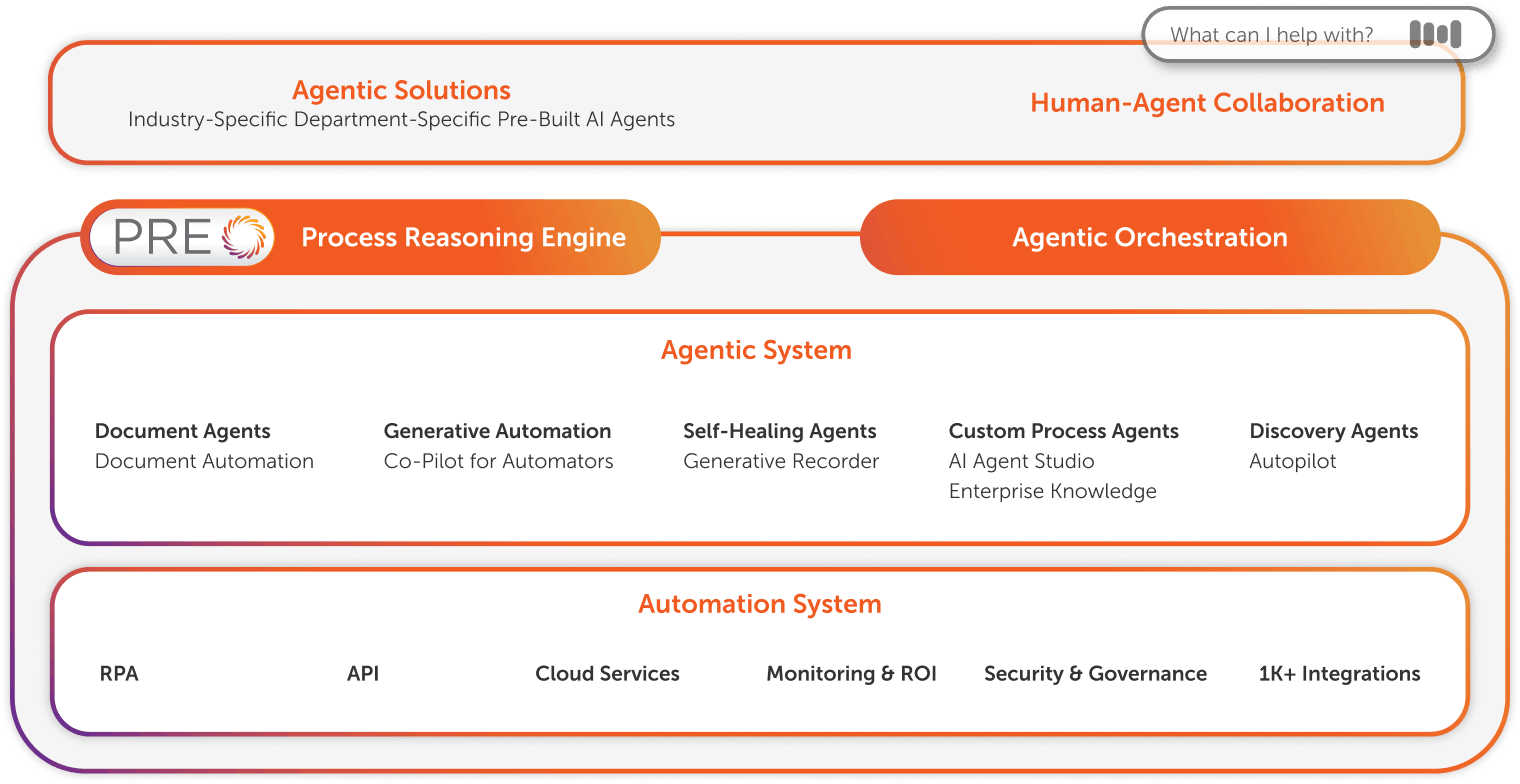

Request a demoDrive operational agility and speed from claims velocity to customer experience with the Agentic Process Automation System.

Eliminate the backlog of document-intensive processes that continue to tie up resources and keep insurers from improving process effectiveness across the business. The Agentic Process Automation System works across legacy systems, enabling immediate productivity and customer experience gains.

Find out why our customers keep coming back.

What real users are saying about Automation Anywhere vs. UiPath.

I’ve used UiPath as a developer. Now, I’m using Automation Anywhere as well. When I compare both, the biggest point is cognitive abilities. The Document Automation is the best in class. You won’t find that even in UiPath.

What real users are saying about Automation Anywhere vs. Microsoft Power Automate.

We also explored Microsoft’s Power Automate. However, it wasn’t as mature or up to an enterprise level at the time. Automation Anywhere had good standards and excellent support, in terms of architecture, design, and user interface, we chose Automation Anywhere. It also has good community support.

What real users are saying about Automation Anywhere vs. Blue Prism.

We had to switch to Automation Anywhere due to the high initial license fee associated with Blue Prism. Automation Anywhere is more cost-effective.

What real users are saying about Automation Anywhere vs. alternative solutions.

Before using Automation Anywhere I checked Blue Prism & Ui Path but I preferred Automation Anywhere because it is best in quality. It also has Document Automation for unstructured data converting in structure.

See how intelligent automation is transforming insurance.

EBOOK

See how AI and RPA empower insurers to invigorate productivity, enhance customer experience and ignite innovation, by embracing digital transformation and automating insurance functions to gain a competitive edge.

Read ebook

WEBINAR

Learn about trends, benefits, and use cases in automation to drive efficiency in Insurance.

Watch webinar

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.