- Login

- Search

- Contact Us

-

Have a question? Our team is here to help guide you on your automation journey.

-

Explore support plans designed to match your business requirements.

-

How can we help you?

-

- AI

AI Without the Hype From pilot to full deployment, our experts partner with you to ensure real, repeatable results. Get Started

- Automation Anywhere AI

-

- Solutions

Featured Agentic Solutions

Accounts Payable Invoice automation—No setup. No code. Just results. Accounts Payable

Customer Onboarding Scale KYC/AML workflows. Customer Onboarding

Customer Support Keep queues moving, even at peak load. Customer Support

Healthcare RCM Revenue cycle management that runs itself. Healthcare RCM

- Products

Platform Features

- Agentic process automation (APA)

- Robotic Process Automation (RPA)

- View all Products

-

- Resources

Get Community Edition: Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.

Featured

Named a 2025 Gartner® Magic Quadrant™ Leader for RPA.Recognized as a Leader for the Seventh Year in a Row Download report Download report

Named a 2025 Gartner® Magic Quadrant™ Leader for RPA.Recognized as a Leader for the Seventh Year in a Row Download report Download report- Become an Expert

- Developer Tools

- Get Support

- View all resources

-

- Partners

Find an Automation Anywhere Partner Explore our global network of trusted partners to support your Automation journey Find a Partner Find a Partner

- Find a Partner

- For Partners

-

Blog

Identifying Automation Opportunities for Retail Banking

Share this:

The retail banking industry is faced with significant challenges to achieve optimal operational efficiency and profitability while providing the highest level of customer satisfaction. Financial institutions are also facing competition from new fintechs that provide online banking, payment services, and tailored customer experiences without being constrained by brick-and-mortar branches and legacy processing systems.

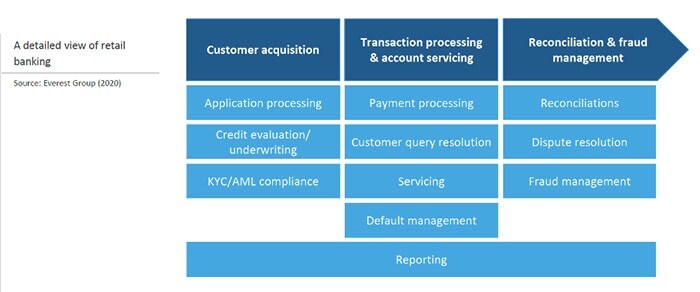

Retail banks offer a wide variety of products, including consumer loans, credit cards, and checking and savings accounts. Operations supporting each of these product lines such as loan fulfillment, underwriting, compliance, customer service, and collections could significantly benefit from automation since many of these processes are manual and document-intensive.

Robotic Process Automation (RPA), especially when combined with artificial intelligence (AI) to support intelligent automation, can accelerate the efficiency of retail bank processing, in addition to enhancing compliance, reducing fraud, and boosting customer service, according to a new report by the Everest Group.

The diagram below summarizes the core processes in the retail banking value chain:

The four quadrants of automation opportunities

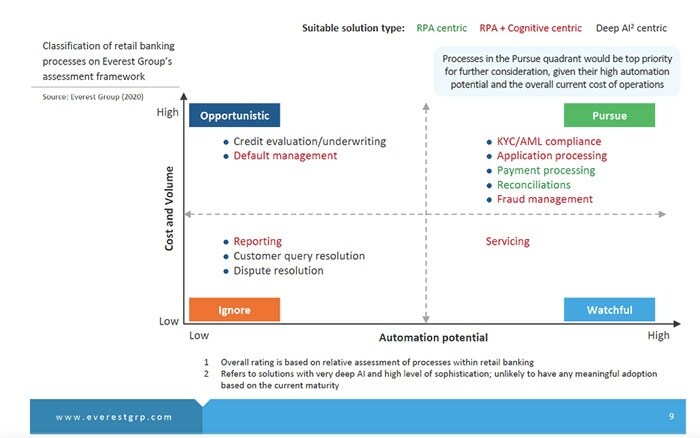

The Everest Group evaluated all of these processes using a proprietary methodology to assess the suitability of processes for automation. Named the Enterprise Value Chain Approach (EVCA), this five-step methodology helps businesses identify business processes, analyze each process, spotlight high-value opportunities for automation, and define metrics to prioritize those opportunities.

Using EVCA scores, processes are divided into the following four quadrants based on cost savings potential and overall automation potential:

- Pursue: Processes that score high on cost savings potential and automation potential fall into this quadrant. These are the highest priority processes to automate.

- Opportunistic: Processes score high on cost savings but low on automation potential. They should be automated only on an “opportunistic” basis. Such opportunities should be pursued only when a use case presents itself during the regular course of business operations where the benefits outweigh the costs.

- Watchful: The processes in this quadrant return relatively little value but are easy to automate. These lower-priority processes can be automated when budget/resource capacity allows for it.

- Ignore: These are difficult to automate and return little value. Ignore them.

In this blog article, we will take a look at one promising process in the “pursue” automation category for financial institutions—KYC/AML compliance—and show how intelligent automation can be applied.

The challenges of KYC/AML monitoring

Of all the operational processes within a retail financial institution, Know Your Customer (KYC) and Anti-Money Laundering (AML) activities can have the greatest impact on a bank’s ability to achieve regulatory compliance. To stay compliant with industry regulations, large financial institutions spend $100-$500 million each year to manage KYC/AML processes. Even so, institutions around the world paid $10 billion in fines in 2019 for regulatory non-compliance.

KYC/AML compliance processes focus on developing an accurate customer risk profile, supporting fraud identification, and conducting ongoing account monitoring. The goal is to validate that customers are who they say they are and that they are not engaged in any criminal activity, such as money laundering, that would put a financial institution at risk.

Validation activities include gathering customer data from multiple internal and external sources, inputting the data into a compliance management system, initiating alerts for more in-depth investigation, and conducting ongoing monitoring to identify any changes in the customer profile or fraudulent activity. For many institutions, these tasks are conducted manually by human workers, which can slow down service delivery and introduce errors, potentially resulting in false positive alerts about a customer’s risk profile.

It’s in the best interest of banks to minimize false positives since they result in avoidable and costly additional research. In addition, these unnecessary investigations may lead to a negative customer experience and the potential loss of a customer’s business.

The benefits of intelligent automation for KYC/AML

In general, intelligent automation combining RPA and artificial intelligence can automate processes and streamline tasks, lowering related operating costs, reducing errors, improving customer satisfaction, and freeing up human workers to perform higher-value work such as the analysis and investigation of high-risk accounts. Intelligent automation offers significant benefits to the KYC/AML process, including:

- Improved due diligence. Intelligent bots can digitize high volumes of documents and the data can be extracted, indexed, and uploaded into a KYC/AML compliance system to quickly assess risk—all without human intervention. In addition, rules-based tasks can be easily automated.

- More accurate customer risk profiles. False positives can be greatly reduced. Instead of sending a customer identification profile (CIP) to be externally validated, a financial institution can employ an automated software bot to handle the task internally, resulting in time and cost savings as well as reducing the possibility of errors. Bots can also be assigned to track documents and to identify any incomplete or inconsistent information.

- Enhanced compliance. Users benefit from seamless access to customer data, automated ongoing transaction monitoring, and regulatory change tracking. Intelligent automation can detect patterns in large volumes of data and also monitor changes in financial regulations.

- Better AML screening and investigation. Intelligent automation can continuously monitor data and send an alert when potentially fraudulent or criminal behavior has been identified, recommending when further investigation is required.

Learn More about Automating Retail Banking.

About Ken Mertzel

Ken Mertzel is the Global Industry Leader for Financial Services and has extensive industry experience in translating financial data into strategic information to improve business performance.

Subscribe via Email View All Posts LinkedInGet to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.