- Login

- Search

- Contact Us

-

Have a question? Our team is here to help guide you on your automation journey.

-

Explore support plans designed to match your business requirements.

-

How can we help you?

-

- AI

AI Without the Hype From pilot to full deployment, our experts partner with you to ensure real, repeatable results. Get Started

- Automation Anywhere AI

-

- Solutions

Featured Agentic Solutions

Accounts Payable Invoice automation—No setup. No code. Just results. Accounts Payable

Customer Onboarding Scale KYC/AML workflows. Customer Onboarding

Customer Support Keep queues moving, even at peak load. Customer Support

Healthcare RCM Revenue cycle management that runs itself. Healthcare RCM

- Products

Platform Features

- Agentic process automation (APA)

- Robotic Process Automation (RPA)

- View all Products

-

- Resources

Get Community Edition: Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.

Featured

Named a 2025 Gartner® Magic Quadrant™ Leader for RPA.Recognized as a Leader for the Seventh Year in a Row Download report Download report

Named a 2025 Gartner® Magic Quadrant™ Leader for RPA.Recognized as a Leader for the Seventh Year in a Row Download report Download report- Become an Expert

- Developer Tools

- Get Support

- View all resources

-

- Partners

Find an Automation Anywhere Partner Explore our global network of trusted partners to support your Automation journey Find a Partner Find a Partner

- Find a Partner

- For Partners

-

Blog

Identifying Automation Opportunities for Property and Casualty Insurers

Share this:

Property and casualty (P&C) insurance, also known as non-life or general insurance, refers to a range of coverages including property insurance that covers items such as automobiles, homes, or commercial buildings, as well as casualty insurance that covers legal liability for injuries or losses incurred by a third-party individual or business.

The insurance industry is faced with significant challenges, not the least of which is fraud. P&C insurers are projected to lose an estimated $80 billion annually in the United States due to fraud, according to the Coalition Against Insurance Fraud. In addition, traditional insurance companies are being pressured by online competitors to improve customer service and offer a personalized digital experience, according to industry analysts.

Robotic Process Automation (RPA), especially when combined with artificial intelligence (AI) to support intelligent automation, can accelerate the efficiency of underwriting and claims processing, in addition to reducing fraud and enhancing service, according to a new report by the Everest Group.

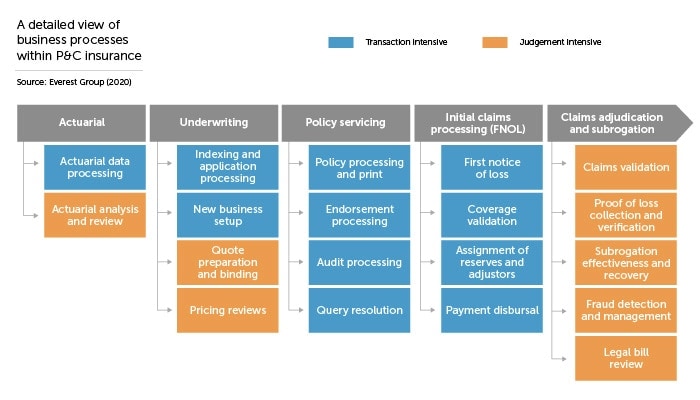

The diagram below summarizes the core processes in the P&C value chain:

The four quadrants of automation opportunities

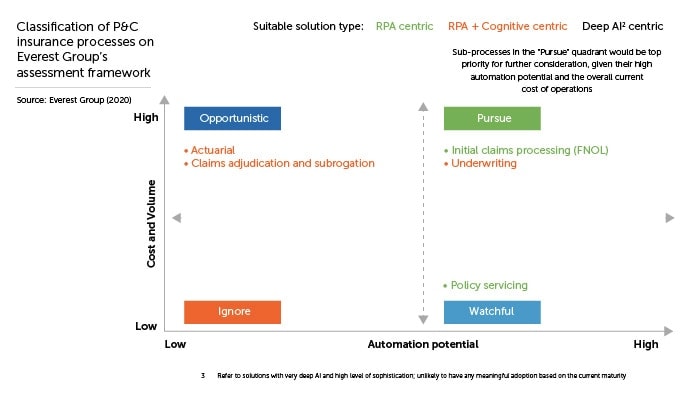

The Everest Group evaluated all of these P&C processes using a proprietary methodology to assess the suitability of processes for automation. Named the Enterprise Value Chain Approach (EVCA), this five-step methodology helps businesses identify business processes, analyze each process, spotlight high-value opportunities for automation, and define metrics to prioritize those opportunities.

With EVCA scores, processes are divided into four quadrants based on cost savings potential and overall automation potential, as follows:

- Pursue: Processes that score high on cost savings potential and automation potential fall into this quadrant. These are the highest priority processes to automate.

- Opportunistic: Processes score high on cost savings, but low on automation potential, should be automated only on an “opportunistic” basis. Such opportunities should be pursued only when a use case presents itself during the regular course of business operations where the benefits outweigh the costs.

- Watchful: The processes in this quadrant return relatively little value but are easy to automate. These lower-priority processes can be automated when budget/resource capacity allows for it.

- Ignore: These are difficult to automate and return very little value. Ignore them.

In this blog, we will take a look at one promising process in the “pursue” automation category for P&C companies — the first notice of loss (FNOL) claims process — and show how intelligent automation can be applied, resulting in significant time and cost savings.

First notice of loss: a perfect match for intelligent automation

Historically, P&C operations have been fraught with manual processes. This is especially true of the FNOL process for P&C insurance claims. FNOL is typically the first step in the formal claims process lifecycle in which the insurance policyholder files an initial report following an incurred loss, and the insurance company opens a new claim file.

Handling loss notifications is complicated since they can be communicated to P&C insurers in many ways: emails, phone calls, online forms, or even fax. Numerous disparate systems are involved, and workflows are often very complex. Documentation received during the process is frequently in the form of paper-based or PDF forms — such as damage estimates, police reports, or doctors’ statements — much of which needs to be manually input and reviewed by claims analysts.

P&C companies realize that to remain competitive, they must invest in digital transformation, which includes automation technologies like intelligent RPA.

Benefits of automating FNOL with RPA

AI-powered RPA enables P&C insurers to automate the FNOL process and significantly improve the claims experience for customers.

Intelligent software robots (“bots”) can easily extract relevant information from unstructured documents coming in through email, fax, USPS, or any other channel, and input the data into the appropriate systems. These bots can also apply rules to triage claims, whereby claims that exhibit certain characteristics can be routed to different workflows. For example, claims of more than $10,000 could be put through a separate, more rigorous adjuster review and approval process. Less complex claims could be automatically approved and quickly settled. Likewise, claims that raised any flags for potential fraud could be tagged and sent to an analyst in a special investigation unit to investigate more closely.

All of these processes could utilize advanced technologies such as machine learning (ML) or smart analytics to reduce overall claims processing time. Automation can address the high volume, repetitive tasks 24/7, so claims professionals can focus on more complex analysis and higher-value work.

Insurers are thus able to lower costs, eliminate errors, reduce fraud, and improve relationships with customers by automating the claims FNOL process. These same intelligent automation technologies can be applied to other areas such as underwriting and policyholder services to improve the entire insurance value chain.

Get More Information on Automating Claims.

About Ken Mertzel

Ken Mertzel is the Global Industry Leader for Financial Services and has extensive industry experience in translating financial data into strategic information to improve business performance.

Subscribe via Email View All Posts LinkedInGet to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.