- Login

- Search

- Contact Us

-

Have a question? Our team is here to help guide you on your automation journey.

-

Explore support plans designed to match your business requirements.

-

How can we help you?

-

- AI

AI Without the Hype From pilot to full deployment, our experts partner with you to ensure real, repeatable results. Get Started

- Automation Anywhere AI

-

- Solutions

Featured Agentic Solutions

Accounts Payable Invoice automation—No setup. No code. Just results. Accounts Payable

Customer Onboarding Scale KYC/AML workflows. Customer Onboarding

Customer Support Keep queues moving, even at peak load. Customer Support

Healthcare RCM Revenue cycle management that runs itself. Healthcare RCM

- Products

Platform Features

- Agentic process automation (APA)

- Robotic Process Automation (RPA)

- View all Products

-

- Resources

Get Community Edition: Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.

Featured

Named a 2025 Gartner® Magic Quadrant™ Leader for RPA.Recognized as a Leader for the Seventh Year in a Row Download report Download report

Named a 2025 Gartner® Magic Quadrant™ Leader for RPA.Recognized as a Leader for the Seventh Year in a Row Download report Download report- Become an Expert

- Developer Tools

- Get Support

- View all resources

-

- Partners

Find an Automation Anywhere Partner Explore our global network of trusted partners to support your Automation journey Find a Partner Find a Partner

- Find a Partner

- For Partners

-

Blog

Automating Procure-to-Pay Processes for Efficiency and Agility

Share this:

The finance and accounting (F&A) function has been transformed by technology over the last decade. This back-office function plays a critical role in supporting strategic business decision-making, improving business profitability, increasing shareholder value, and optimizing working capital. Still, finance professionals today are under pressure to improve operations and cut costs even further.

Automation is enabling F&A to play this role in a much more efficient and effective manner. The F&A value chain is full of processes that are terrific candidates for Robotic Process Automation (RPA), according to a new report by the Everest Group.

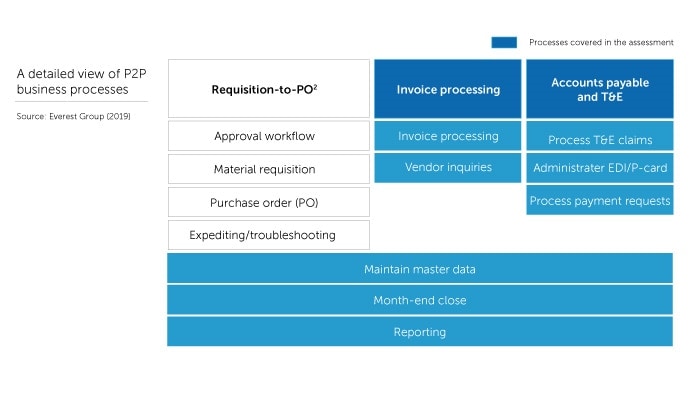

Procure-to-pay (P2P) is one such area of opportunity. The P2P function is responsible for the purchasing of goods and services needed to operate the business. Organizationally, this function integrates procurement with accounts payable and is central to the financial health of a business. Why? Because no matter what industry a company competes in, it must find a way to efficiently control purchasing and cash flow, build vendor relationships, and maximize its buying power.

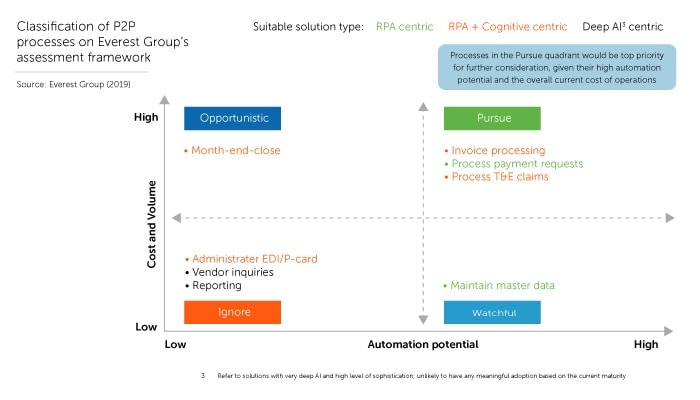

The Everest Group put all these processes through a rigorous evaluation using a proprietary methodology and categorized them into four groups based upon the potential for automation and cost reduction — pursue, treat as opportunistic, be watchful, or ignore.

In this blog, we will look at one recommended process, invoice processing, in the “pursue” category and show you how using intelligent automation — can be applied, resulting in significant time and cost savings.

The four quadrants of automation opportunities

The Everest Group has established a proprietary method to assess the suitability of processes for automation. Named the Enterprise Value Chain Approach (EVCA), this five-step methodology helps businesses identify business processes, analyze each process, spotlight high-value opportunities for automation, and define metrics to prioritize those opportunities.

The EVCA scores divide processes into four quadrants, based on cost savings potential/volume of transactions and the overall automation potential, as follows:

- Pursue: Processes that score high on both cost-savings potential and automation potential fall into this quadrant. These are the highest priority processes to automate.

- Opportunistic: Processes, which score high on cost savings but low on automation potential, should be automated only on an “opportunistic” basis. Such opportunities should be pursued only when a use case presents itself during the regular course of business operations where the benefits outweigh the costs.

- Watchful: The processes in this quadrant return relatively little value, but are easy to automate. These lower-priority processes can be automated when budget/resource capacity allows for it.

- Ignore: These are difficult to automate and return very little value. Ignore these processes.

We will highlight invoice processing as an example of a high-priority process that businesses should automate.

Invoice processing: a perfect match for intelligent automation

Traditionally, invoice processing depended on numerous manual, transactional tasks performed by human workers. AP invoice processing required people to manually classify invoices, extract data from the invoices, validate the information against procurement purchase orders (POs) and receipts, and process payments.

Invoice processing is complicated by the fact that invoices are not uniform and can be radically different from one another. Also, many invoices consist of unstructured data in the form of PDF files or handwritten documents. Additionally, invoices can be delivered to the business in any number of ways: by email, USPS, private courier, fax, or electronic document interchange (EDI). In global enterprises, different geographic regions or languages make processing invoices even more complicated.

As a result, invoice processing in the past was a slow, time-consuming, and error-prone process that is ripe for RPA. A human worker had to look at each invoice individually, interpret the unstructured data, and input it into systems manually.

With intelligent automation, invoice processing can be automated from end to end. Invoice processing is even more effective when RPA is supplemented with artificial intelligence (AI), allowing RPA software robots (“bots”) to process and analyze unstructured data in addition to structured information.

Bots can enable people to focus on handling exceptions that were flagged by bots as not matching purchase orders or goods receipts.

Benefits of automating invoice processing

RPA with cognitive capabilities offers significant business benefits. First, automation reduces the operational cost of invoice processing. In addition, it drives increased accuracy by reducing manual errors. Suppliers also get paid in a more timely manner, forestalling penalties and interest payments. Most importantly, human workers have time freed-up for more value-added tasks that require their expertise and judgment.

Optimize Your F&A Processes with Automation.

About Ken Mertzel

Ken Mertzel is the Global Industry Leader for Financial Services and has extensive industry experience in translating financial data into strategic information to improve business performance.

Subscribe via Email View All Posts LinkedInGet to know the Agentic Process Automation System.

For Students & Developers

Start automating instantly with FREE access to full-featured automation with Cloud Community Edition.